What our successful students say

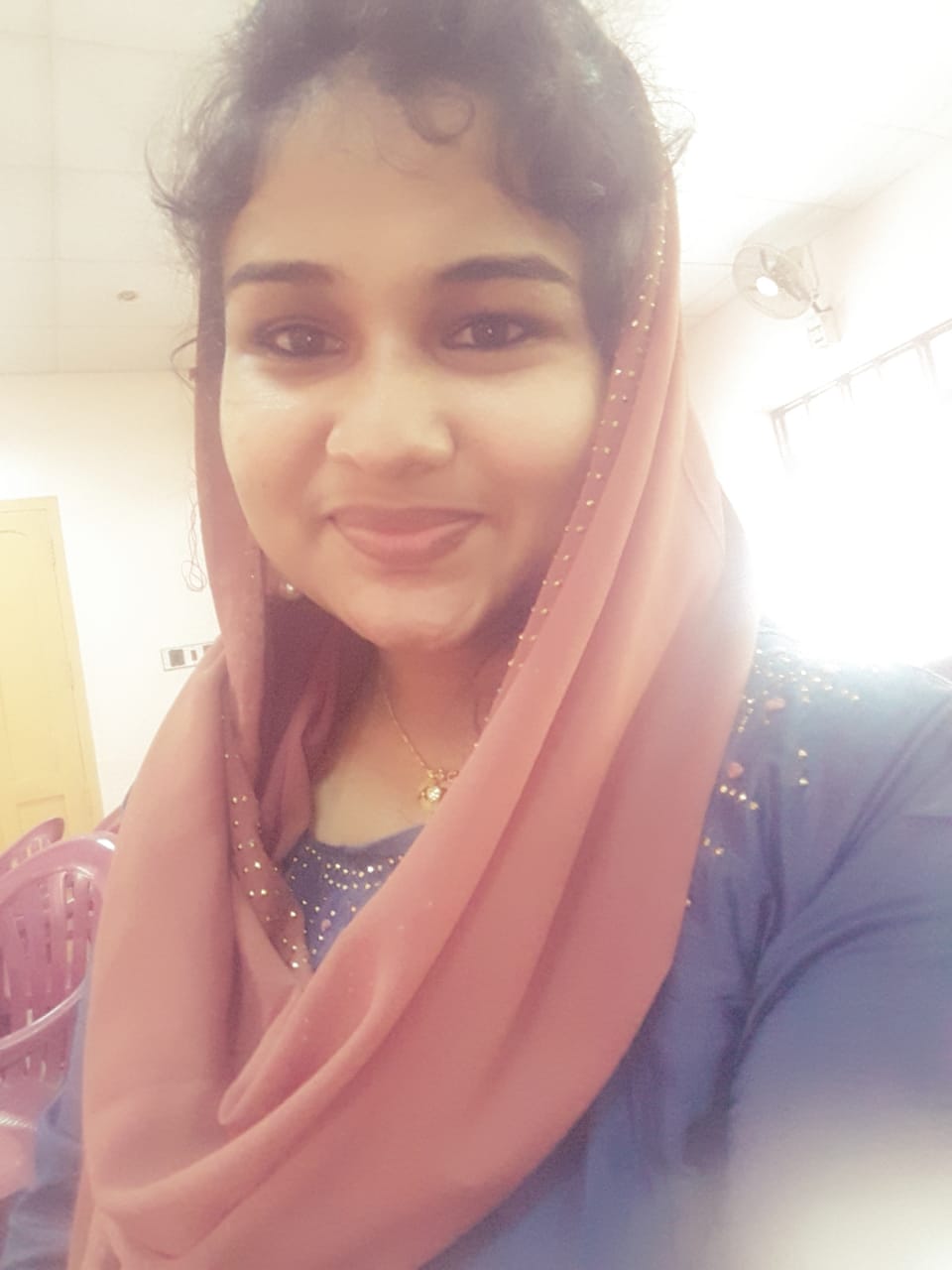

Training from Skillspark really helped me in many ways. Did my Digital Marketing training along with Multimedia courses. Right now, I am confident enough to work in related industries. Thanks, and really recommended this Institution.

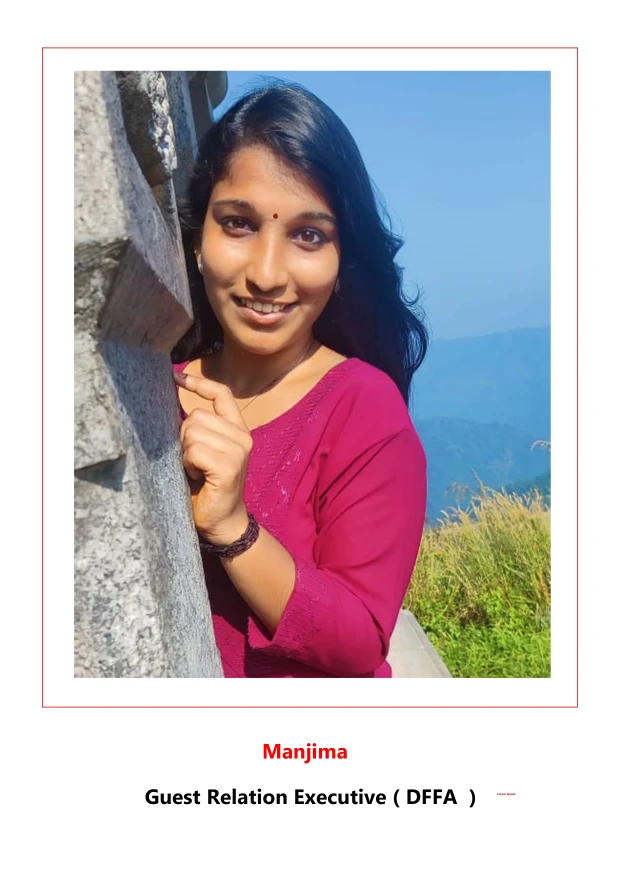

I really want to thank the teachers and skillspark family. Along with classroom teaching they are providing videos of the same topics . Videos are awesome. Especially the way faculties explain. It’s very nice. It feels as if one is sitting in the class. Skillspark institution providing very good services to students. Really thanks.