Automation is redefining the accounting landscape, shifting professionals from manual processing toward analysis, compliance, and decision support. As AI-driven tools and intelligent systems become integral to financial workflows, accountants who combine domain expertise with digital proficiency will shape the future of the profession. Discover how technology is changing accounting careers, what skills employers value, and how professionals can stay relevant.

The accounting sector stands at a pivotal crossroads in 2026, where automation and AI are no longer futuristic concepts but everyday realities reshaping how professionals work, firms operate, and businesses thrive. From routine data entry to complex compliance checks, technology is handling repetitive tasks with unprecedented speed and accuracy, freeing accountants to focus on strategic advisory roles that deliver real value.

For aspiring and current accounting professionals, this shift presents both challenges and immense opportunities. At Skillspark The Finishing School, we specialize in bridging this gap through industry-standard skill development courses designed to equip you with the tools to thrive in an automated accounting landscape.

In this post, we’ll explore the rise of automation in accounting, its key benefits, emerging trends in 2026, potential impacts on jobs, and why upskilling is essential for long-term success.

What Is Automation in the Accounting Sector?

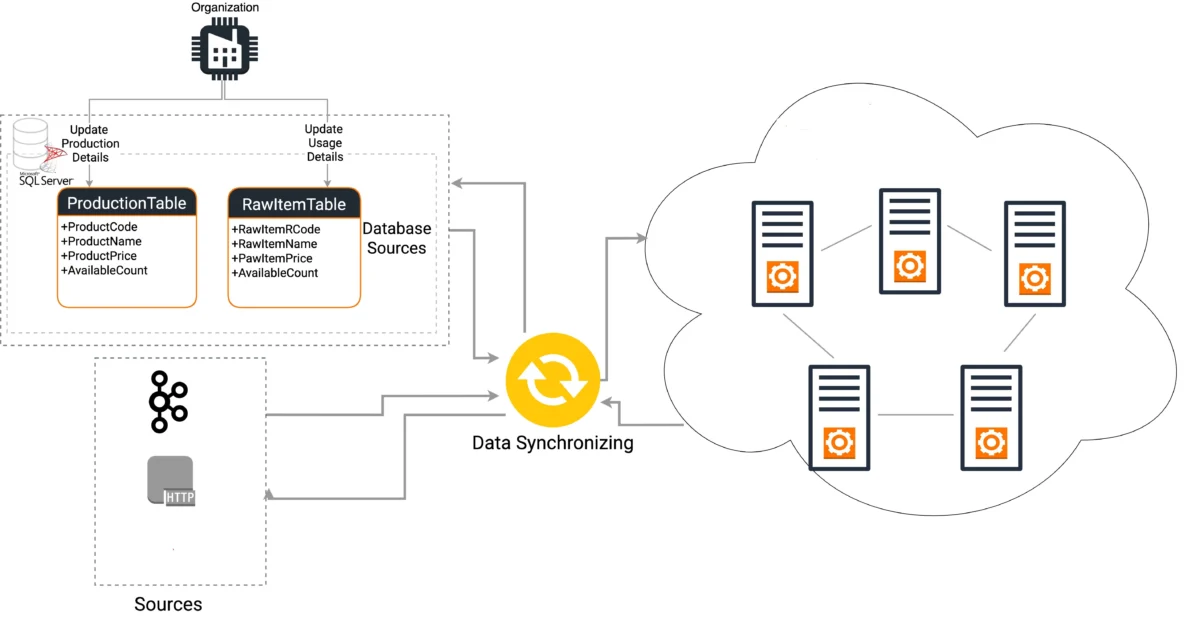

Accounting automation refers to the use of software, robotic process automation (RPA), and increasingly artificial intelligence (AI) to handle repetitive, rule-based tasks traditionally performed manually. This includes:

![]()

- Data entry and transaction processing

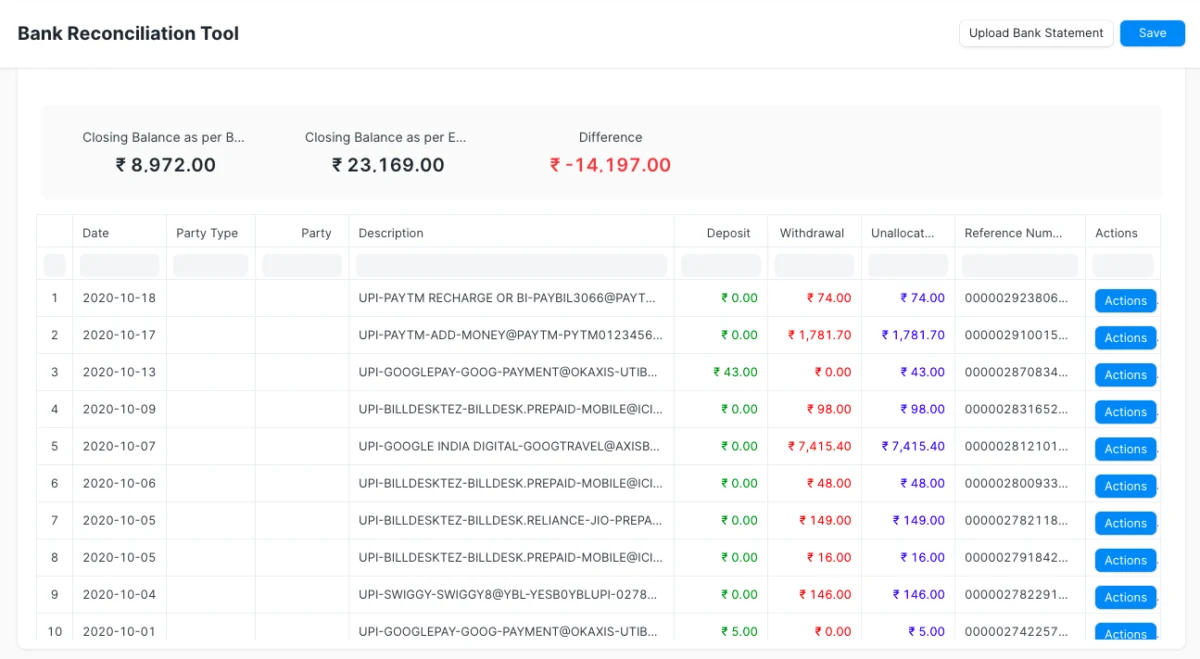

- Bank reconciliations

- Invoice processing and accounts payable/receivable

- Payroll calculations

- Financial reporting and compliance checks

With advancements in intelligent process automation (IPA) and generative AI, tools now go beyond simple rules—they interpret unstructured data (like emails or contracts), detect anomalies, predict trends, and even draft reconciliations or reports.

In 2026, the global AI accounting market is projected to reach $10.87 billion, driven largely by small and medium enterprises (SMEs) adopting these technologies at a rapid 44.6% CAGR. Cloud-based platforms integrate AI natively into core systems, making automation accessible without massive upfront investments.

Key Benefits of Automation in Accounting

Adopting automation delivers tangible advantages that enhance efficiency, reduce risks, and boost profitability.

- Significant Time Savings and Increased Productivity Automation eliminates hours spent on manual tasks. Firms report completing tasks in 31% less time on average, with AI saving professionals 2+ hours per week. This allows teams to handle more clients, close books faster (up to 7.5 days quicker in some studies), and redirect efforts to high-value work.

- Improved Accuracy and Reduced Errors Human error in data entry or calculations can lead to costly mistakes. Automation achieves near-perfect precision—surveys show 98% improvement in accuracy—minimizing compliance risks and audit issues.

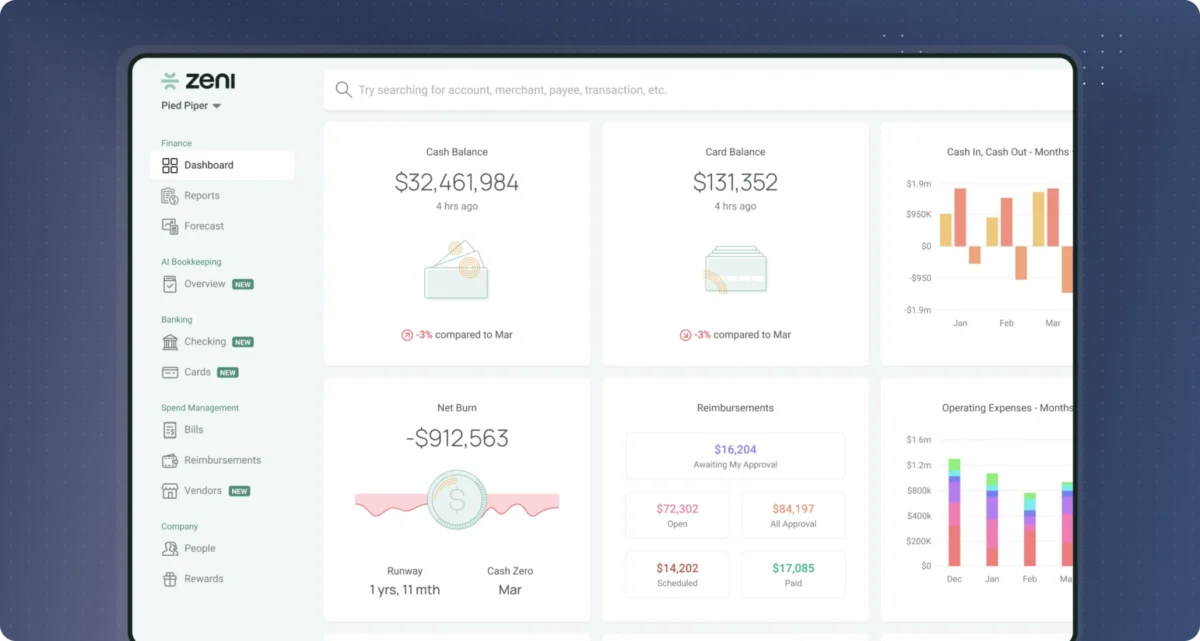

- Enhanced Data Insights and Decision-Making Real-time processing provides up-to-date financial data, enabling predictive analytics, anomaly detection, and better forecasting. Accountants shift from number-crunchers to strategic advisors offering proactive insights.

- Cost Reduction and Scalability By automating routine processes, firms lower labor costs for repetitive work and scale operations without proportional staff increases. This is especially valuable amid talent shortages.

- Better Compliance and Security Automated systems ensure consistent adherence to regulations, with built-in audit trails and enhanced data security features.

These benefits are backed by widespread adoption: 95% of firms implemented automation in recent years, with top uses in payroll (47%), accounts payable/receivable (46%), and transaction processing (43%).

Current Trends in Accounting Automation for 2026

2026 marks a maturation phase for AI in accounting, moving from experimentation to meaningful impact.

- AI Becomes Native in Core Software — Tools for bookkeeping, workflow, and reporting now embed AI, boosting firm capacity and revenue without adding hours.

- Agentic AI for Autonomous Tasks — Advanced AI handles targeted finance functions independently, like continuous variance detection.

- Shift to Advisory Services — With routine work automated, firms emphasize client advisory, data-driven strategy, and personalized guidance—93% already offer advisory, with many expanding.

- Focus on Data Quality and Integration — Success hinges on clean, integrated data; disconnected systems become liabilities.

- Talent Evolution — Firms seek tech-savvy professionals skilled in AI, analytics, and communication.

Experts predict 2026 as the year AI meaningfully increases realization rates and partner revenue.

The Impact of Automation on Accounting Jobs: Threat or Opportunity?

Concerns about job displacement persist, with estimates suggesting up to 40-50% of routine tasks could automate by 2030. Roles like basic bookkeeping or payroll clerks face decline.

However, evidence shows AI augments rather than replaces accountants. Studies reveal AI users support more clients, close books faster, and deliver higher-quality service while spending less time on back-office work.

The U.S. Bureau of Labor Statistics projects 5.8% growth in accounting/auditing jobs through 2033—faster than average—driven by demand for human-AI collaboration in analysis, risk management, and strategy.

Automation creates more engaging careers: less drudgery, more problem-solving and client interaction. It addresses talent gaps by making the profession attractive to younger workers.

The key? Adaptation. Accountants who embrace technology thrive, while those who resist risk obsolescence.

Why Upskilling Is Crucial in the Automated Accounting Era

To succeed in 2026 and beyond, professionals need a blend of traditional expertise and modern skills:

- Proficiency in AI-powered tools and automation software

- Data analytics and interpretation

- Strategic advisory and business acumen

- Soft skills like communication and ethical judgment

This is where Skillspark The Finishing School excels. Our industry-aligned courses in the accounting domain provide hands-on training in automation tools, AI applications, cloud accounting, advanced Excel, data analytics, and advisory practices—aligned with current standards and employer needs.

Whether you’re a fresh graduate or experienced professional, our programs help you transition from task-oriented roles to strategic ones, ensuring you’re future-ready.

Conclusion: Embrace Automation for a Brighter Accounting Future

The accounting sector in 2026 is more dynamic and rewarding than ever. Automation and AI handle the mundane, allowing professionals to deliver strategic value, build stronger client relationships, and drive business growth.

Rather than fearing change, view it as an opportunity to elevate your career. By upskilling now, you position yourself at the forefront of this transformation.

At Skillspark The Finishing School, we’re committed to empowering the next generation of accounting experts. Explore our courses today and take the first step toward mastering automation in accounting.

Ready to future-proof your accounting career? Visit Skillspark and enroll in a course that aligns with industry demands. The future of accounting is automated—and it’s bright for those prepared.